Uber Thriving in Argentina Once Again Thanks to Bitcoin

Eduardo Gomez started with Bitcoin in 2012, though he didn't quite understand what he was getting himself into nor how it would change his life.

Dorsum in his home state of Venezuela, the struggling reckoner science educatee signed up to manually process thousands of captchas at a fourth dimension, and he received Bitcoin in return. Little by little, Eduardo became intrigued. He saw bitrapreneurs pop-up all effectually him as savvy hackers set up mining operations that took advantage of the country'south subsidized though irregular electricity. He started reading more, writing more, and pretty soon he became a recognized authority on all things crypto.

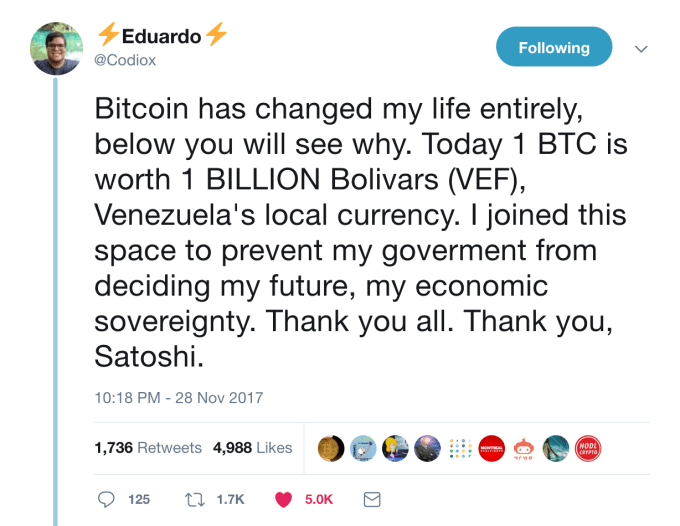

Eventually he would exist hired by a company that allows people to purchase things on Amazon using Bitcoin. When Venezuela became unlivable, Eduardo'due south company helped him and his back up team relocate to Argentina. In a moment of euphoria, Eduardo wrote:

Though Venezuela crumbled effectually him, Eduardo constitute a way to opt-out of his regime's mass-imposed misery. He notwithstanding worries about his family and friends, only he'southward grateful to accept had a option. Dissimilar the Silicon Valley-based techno-libertarians and utopians who claim Bitcoin will salve us from inevitable tyrannical government meddling, Eduardo feels Bitcoin actually did save him from tyrannical regime meddling. He believes it can do the same for other Latin Americans, as well.

Since its triumphant arrival to mainstream polite conversation, Bitcoin and its underlying applied science blockchain accept promised to revolutionize everything from commerce to voting .

While blockchain appears to exist fulfilling its hope , many wonder if Bitcoin will ever become effectually to acting as a feasible currency rather than simply a store of value or speculative asset.

While Bitcoin tin can exist credited with spawning a new industry of cryptocurrency, in 2018 we still seem to be a means away from purchasing ice cream or hourly parking with Bitcoin — or whatever other cryptocurrency for that matter.

If Bitcoin is to become a feasible means of exchange, Latin America would appear to exist the currency's offset point of entry on its journeying toward ubiquity. Indeed, the region's long history of economic mismanagement makes Bitcoin adoption as much a necessity as a luxury.

For example, when yous arrive at Simon Bolivar International Drome in Caracas you'll see an official exchange rate listed above the currency substitution kiosks, and y'all might be tempted to cash-in your U.South. dollars for whatever the local currency happens to be that calendar month .

Possibly even before you leave the airport someone, maybe a taxi driver, will arroyo y'all and offer a completely different and far more beneficial exchange charge per unit. Though the government purports to command the exchange rate across the land of 30 million people, it struggles to control the exchange rate inside the aerodrome.

If you're dining in Buenos Aires and you lot offer to pay in U.S. dollars, y'all'll be happy to know you'll receive a favorable substitution rate for your Benjamins. However, once yous pull a bill from your pocket, you may find yourself in a seemingly nonsensical word with the waiter most the quality of the bill and how the slightly bent edges means a lower rate than the 1 initially offered.

Finally, if you arrive in Quito, Ecuador equally a tourist, you'll exist delighted to see that the country has no currency of its own in circulation: the land has used the greenback since a financial crunch in 1999 destroyed the banking organization and the country's currency. In an human action of desperation, the country switched to the U.S. dollar.

Your glee may turn to discomfort after you ask a taxi commuter to break a $20 nib and you'll see him fidget nervously and probably ask you for exact change. Few things are harder in the Andean capital than breaking a $20. Never having the correct mix of bills is one of the downsides of not controlling your own money supply.

For your average tourist, these encounters are befuddling. To economists, these incidents are both distressing and bemusing: all of the worst-case currency management scenarios first-twelvemonth economics students written report in textbooks seem to come to life in the countries that are fed by the Amazon river and its tributaries — similar a twisted Narnia for economists.

To the local populations of the aforementioned countries, managing currencies has turned mutual people into artisanal forex traders. While abrasive, volatile currencies have been effectually for as long equally anyone tin remember, and people adjust their behavior in order to survive. If yous want to purchase an apartment in Buenos Aires, for example, you'll be expected to arrive with the payment in U.Southward. dollars in cash. Best to invest in a expert briefcase.

Diff access to applied science often means unequal admission to the benefits of technology.

As crypto enters its peak or its decent, depending on who you lot ask, Latin America offers the perfect testing ground for the technology's practical application. Specifically, Argentines and Venezuelans would announced to be the test group for the employ of crypto currencies as an alternative to unstable and unreliable national currencies.

In a parallel earth, both Argentina and Venezuela would be the region'south richest countries, were it not for their leaders' penchants for mismanagement and abuse. With oil reserves greater than those of Saudi arabia, Venezuela should be thriving. Instead, its experiment with socialism has resulted in more than ii million people leaving the land , a wrecked economy and a humanitarian crisis that threatens regional stability.

Argentina's current crisis is far more complex, and nonetheless too more than predictable due to the country's history of smash and bust.

Despite the initial optimism voiced past foreign investors when a right-leaning pro-market government came to ability in 2017, such optimism has not been reflected in support for the peso.

The peso has suffered due to, amongst other factors , a strengthening dollar, dwindling foreign currency reserves and investor mistrust. Inflation caused by past policies of over-printing money to service local debt combined with the current government's elimination of energy subsidies ways that Argentines can't be sure on Monday what their money will be worth on Friday.

The theatrics of Argentina's politics also doesn't inspire confidence, and breaking news can oft send the peso on nosedives. Stories of corruption unfold like Emmy-winning soap operas.

For example, the recently discovered notebooks of a government chofer reveal that businesses shut to the current president are alleged to have paid bribes to its bitter rivals from the previous authorities. Regardless of their ideological differences, Latin America'due south political class is often united in its penchant for corruption.

The cyclical nature of Argentina's currency crisis is what gives some hope that the country can become the get-go to develop a thriving national Bitcoin market. Already a hotbed for blockchain-based companies such as Ripio , Buenos Aires has a college percent of businesses that have Bitcoin than New York. By the terminate of 2018, Argentine republic volition have more than 100 Bitcoin ATMs , a number expected to increase to 1,600 past the stop of 2019.

For Agustina Fainguersch , an Argentine entrepreneur who helps companies, including many in Latin America equally managing partner at Wolox , manage digital transformation through the adoption of technologies such as the blockchain, Bitcoin is a practical solution for the average Argentine only trying to make ends meet.

"In Argentina, we exchange pesos into dollars and then back again within the bridge of a week," she says. Given that the peso has lost 50 pct of its value confronting the dollar since the beginning of 2018, most are changing coin for the purpose of brusk-term survival rather than long-term savings. "Many Argentines are oft but trying to brand certain they take plenty money to cover basic expenses."

According to Fainguersch, the advantage Bitcoin has over other currencies is its increasingly availability, and as such acts every bit an culling to the U.Southward. dollar. Fainguersch has seen how, over the span of a few years, more than and more Argentines tin admission the cryptocurrency and hands exchange pesos. "And so long equally it'southward less volatile than the peso, it's attractive. Argentine's accept a long history of navigating volatility," notes Fainguersch.

That volatility, however, is likewise a risk that places Bitcoin at a disadvantage when compared to the U.S. dollar. Also widely available, the dollar is relatively stable and relatively easy to substitution, though non without burdens and risks, such as falsified bills, hence the extra-value placed on crisp bills.

The futurity of Bitcoin will depend on which narratives go the meta-narratives.

For Matías Bianchi , the Argentine political scientist and founder of the regional think-tank Asuntos del Sur , the demand for Bitcoin in Argentina follows a familiar pattern: Like much technology that promises to democratize access to something, the benefits of said applied science most likely end up helping a wealthy few at the expense of the increasingly difficult-luck masses.

In the example of Bitcoin, Bianchi opines that its adoption in Argentina is driven in large part past a wealthy class that has e'er looked for ways to subvert the country'southward institutions to protect its wealth and to benefit from speculative financial activities. "Bitcoin allows the elites to opt-out of the poor decisions made by the government they help install." Later on all, unequal admission to applied science often means unequal access to the benefits of technology.

For Bianchi, talk of an alternative to the national currency is elitist hogwash. Fifty-fifty if a larger and larger pct of Argentines utilise Bitcoin, Bianchi argues, 100 percent of Argentines still need to use pesos. Every bit such, opting out of the peso is a luxury for some merely not for a viable solution for all. In Bianchi's view of the world, Bitcoin is more than like a modernistic-day offshore account that removes wealth from the economy and shifts the brunt of bad government to the poor. It's like a Cayman Islands account on your phone, and in countries where abuse is rife and stability is rare, such applied science is leap to thrive.

For Venezuelans arriving in Argentina like the aforementioned Eduardo Gomez , their new country's currency woes are not unfamiliar. As previously mentioned, Eduardo was a educatee in Venezuela when he first discovered Bitcoin. As the lesser fell out of the Venezuelan economy, Bitcoin mining became a popular activity in a country where everything is subsidized, including free energy. Somewhen the authorities caught on and cracked down, just not earlier a nascent Bitcoin community took class.

Undemocratic Socialist governments tend to supersede economical elites with elites who are connected to the sources of power, and, according to Gomez, people with connections in the regime eventually took over the Bitcoin mining space. Venezuela even launched its own cryptocurrency, the Petro , whose value is tied to oil production. The Petro has been met with skepticism from both crypto-enthusiasts as well as average Venezuelans who have long lost faith that the government responsible for their problems is capable of solving them.

Equally previously mentioned, Venezuelans take been leaving their country en masse to escape the entirely human-made crisis that has engulfed their land, and more than 130,000 have settled in Argentina . Gomez sees the parallels between Argentina'southward current predicament and the one he left behind in Venezuela, though he feels Argentine republic'due south crisis is tame compared to the consummate social breakdown suffered in Venezuela.

Compared to Venezuela, trading Bitcoin in Argentina is much easier: users in both countries employ LocalBitCoin.bom to connect with buyers and sellers to facilitate converting money to and from local currencies. The procedure is somewhat archaic and not without risks. Dissimilar in Venezuela, in Argentina many money exchangers also offering Bitcoin exchange services. Whereas in Venezuela buyers and sellers run the risk of the authorities discovering their Bitcoin activities and blocking their bank accounts, in Argentina the government is more concerned about individuals not declaring their income or capital gains.

Both Argentine republic and Venezuela accept offered the ideal weather condition for the development of national Bitcoin communities, including the two key ingredients: subsidized energy and unstable national currencies.

Every bit a result, both countries have benefited from the emergence of developer communities focused both on cryptocurrencies every bit well equally blockchain-enabled technologies. Nonetheless, neither country is likely to fulfill the Bitcoin fantasy of replacing their national currencies, nor fifty-fifty overtaking the greenback as an alternative to unstable national currencies.

Bitcoin's ultimate use cases are more likely to appear forth the lines of existing power structures. Wealthy people in Argentina will use Bitcoin to hide their money. Corrupt Venezuelan officials will find a fashion to enrich themselves at the cost of the struggling masses. Having said that, if Bitcoin becomes as stable as the U.South. greenback, its utilize as a store of value will continue to increase.

Other innovations volition as well emerge: as Gomez points point, the launch of Coinbase's USD money , a cryptocurrency pegged to the U.S. dollar, could brand it a lot easier for people to move money between dollars, pesos and bitcoins without the demand to bear physical cash. One of Argentina'south leading Bitcoin thinkers, Santiago Siri , has proposed to the country'due south Central Banking concern that it hold 1 per centum of its foreign currency reserves in cryptocurrency. Though the plan is unlikely to succeed, Argentine republic's drastic circumstances has opened the door for out-of-the-box thinking.

Is it easier for engineering science to co-opt power than it is for power to co-opt applied science?

The emergence of Bitcoin as an alternative to the U.Due south. dollar volition not reduce the need for sound budgetary policy, nor will the stability promised past the U.Due south. dollar become less attractive for the average Argentine or Venezuelan looking to brand ends run into rather than speculate away their savings. In either instance, Bitcoin does non supercede the need for sound institutions.

Of class, if President Trump is successful in gaining control of the U.S. Federal Reserve in gild to begin manipulating monetary policy to do good his short-term political agenda, the U.S. dollar could lose its bewitchery. So far, withal, U.S. institutions appear to exist fairly resilient in the face of the type of intrusive leadership Latin Americans know all as well well.

Though its proponents will keep to tout Bitcoin's superiority vis-à-vis fiat currencies, Bitcoin's ultimate claiming is that it is hard to understand and will therefore be defined by stories nosotros tell about it. In other words, the future of Bitcoin will depend on which narratives become the meta-narratives: volition Bitcoin exist defined by the Eduardo Gomez stories of individuals who escape systems of tyranny thanks to Bitcoin, or the corrupt government officials who receive bribes in their anonymous crypto-wallet, or the drug traffickers who evades detection past shifting from U.S. dollar payments to crypto?

Over 50 years ago Marshall McLuhan wrote, "the new media and technologies by which we amplify and extend ourselves constitute a huge collective surgery carried out on the social trunk with complete disregard for antiseptics." Bitcoin is the perfect example of a surgery we are undertaking on the body politic without necessarily understanding the far-reaching consequences. Nosotros have to consider that making policy decisions based on the currency'southward theoretical hope may not outcome in a better earth.

At the same fourth dimension, we should also exist open to re-thinking how the world operates for the sake of empowering people through technology. The challenge for democratizing technologies is that they must take on and overcome existing power structures. In Latin America institutions are often weak, which is part of the reason why Bitcoin tin can flourish there: the poison and the antitoxin spring from the same well. That doesn't mean, yet, that there aren't powerful and resilient interests filling the voids left by those floundering institutions.

Ultimately the question for Bitcoin in Latin America and elsewhere in the world is post-obit: Is it easier for engineering to co-opt ability than it is for power to co-opt technology? Argentine republic and Venezuela are putting that question to the examination. The earth watches.

Source: https://techcrunch.com/2018/11/20/can-bitcoin-find-its-practical-use-case-as-a-currency-in-latin-america/

0 Response to "Uber Thriving in Argentina Once Again Thanks to Bitcoin"

Post a Comment